The way we handle money and conduct transactions is undergoing a transformative evolution in the current digital era. Mobile payment technology offers an exquisite fusion of accessibility and innovation, catering to the demands of our modern lifestyle, where convenience reigns supreme. Whether indulging in online shopping or purchasing at local stores, mobile payment solutions provide a flawlessly seamless financial experience. This article delves into the advantages of mobile payments and elucidates why they have become an indispensable facet of everyday commerce.

Embracing the Convenience of Mobile Payments

By embracing the convenience of mobile payments, transactions can be effortlessly streamlined, and users can also relish a seamlessly integrated experience that seamlessly blends into their daily lives. Mobile payments epitomize a paradigm shift towards more efficient and user-centric shopping experiences, from a simple tap on your phone to swiftly confirming purchases. Let’s delve into the specific advantages they offer.

Ease of Use

The convenience of mobile payments is unparalleled. With just a few taps on their smartphones, users can effortlessly make purchases without the hassle of physical wallets or the complexities of cash or cards. This user-friendly feature renders mobile payments accessible to individuals across all age groups and levels of technological proficiency.

Speedy Settlements

Mobile payments facilitate nearly instantaneous transactions, whether reimbursing a companion or making a purchase at a grocery store. This process is significantly swifter than conventional payment methods, saving you time and unnecessary inconvenience.

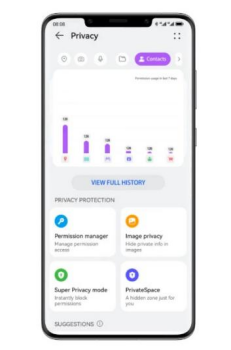

Enhanced Security

Utilizing mobile payments offers enhanced security features absent in traditional payment methods. For instance, a huawei phone incorporates cutting-edge encryption and biometric verification, ensuring that each transaction is both impeccably secure and completely private.

Wide Acceptance

The global acceptance of mobile payments is experiencing exponential growth as many retailers and service providers acknowledge their myriad advantages. This widespread adoption empowers users to seamlessly rely on this cutting-edge payment method for all their purchasing needs, irrespective of geographical constraints.

Reward Benefits

Numerous mobile payment platforms offer rewards programs that are not accessible through traditional payment methods, thereby providing supplementary advantages such as cashback, discounts, or loyalty points to augment the value of each transaction.

Reduced Contact

In today’s health-conscious world, mobile payments offer an alluring advantage: they obviate the necessity of handling cash or touching card terminals, providing a contactless and hygienic means to conduct transactions.

Budget Tracking

Mobile payment apps often come equipped with integrated budgeting tools that are immensely beneficial for users in monitoring their expenditures in real time, thereby ensuring financial well-being and facilitating precise future expense planning.

Integration Ease

The seamless integration of mobile payment systems with other digital services and apps is typically straightforward, greatly enhancing their utility. This integration can encompass a wide array of features, ranging from e-commerce platforms to sophisticated financial planning tools, thereby creating a harmonious digital financial ecosystem.

Conclusion

The adoption of mobile payments transcends the mere embrace of novel technology—it entails adapting to a lifestyle that esteems efficiency, security, and versatility. Mobile payments’ extensive array of benefits, ranging from heightened security to seamless integration, cater to contemporary consumers’ and businesses’ requisites. As this technology continues its evolution and expansion, its role in shaping our financial transactions management will be further fortified, rendering it an indispensable tool for the modern world.